You might have heard of service fees at restaurants and wonder if this could effectively boost profit or if it’s merely a trap that could backfire on your business.

There are always two sides to every coin; all you need to do is figure them out to play your cards well.

To help you weigh down your decision, this article prepares you with the pros and cons and tools, like restaurant ordering management, to help you better your services.

Table of Contents

ToggleWhat is a service fee?

Service fees, or service charges, are collected as payment for services related to a customer’s purchased product or service.

Let’s say you’re offering a bottle service in your restaurant. As part of the service, your staff can exclusively prepare and serve the wine for a more VIP experience.

Here, you can add a fee from the bill as pay for the exclusive service given by your staff.

But how? Corporate Finance Institute explained that a service fee should be a certain percentage of the total bill you set as the owner.

An example is in British Columbia, where an unspoken rule sets service fees at 10 percent of the total bill.

This can go up 20 percent, depending on your discretion.

Is the service charge the same as the tip: Comparative analysis

Whether the service charge is the same as the tip is often encountered as these terms are used interchangeably.

By definition and nature, both are different, though they are related to compensating service staff.

As mentioned, service charges or restaurant gratuity fees are mandatory fees added to a bill and are often distributed among employees or allocated for operational costs.

This means the customer pays for it regardless of the service quality.

Contrary to this, a tip is a voluntary amount given by the customer to reward a good service experience, whether it is for a staff member or for the business in general.

So, the key difference here lies in their mandatory versus discretionary nature and how they are allocated.

Note: Additional fees are often taxed and may not go entirely to the service staff, while tip is considered as direct income for employees.

Pros of having a restaurant service charge

Many starters feel intimidated into adding a restaurant service fee to their policies, as these can turn customers off.

But if executed right, this smart strategy offered profitable benefits.

In fact, Square, a point of sale (POS) system, found out that in the third quarter of 2024, 3.7 percent of restaurants included service fees in their restaurant transactions. When we dug deeper, we found there are a ton of reasons behind this.

Improved wage stability for the staff

Service fees guarantee that your staff will have a consistent and reliable additional source of income.

Unlike traditional tipping service systems, where the earnings fluctuate based on the customer’s generosity and varying business volume, these service fees offer a more predictable compensation structure because of their fixed percentage format.

This approach ensures that employees, whether from the front-of-the-house to the back-of-house, receive fair and stable wages that aim to reduce financial uncertainty.

It can foster a more equitable work environment that reflects their dedication to assisting their customers.

Simplified guest experience

One of the key advantages of service fees in restaurants is that they offer guests a simplified experience.

Instead of having them calculate how much to give and navigate the tipping cultural norms, a fixed service fee creates clarity and ease during the payment process.

It eliminates potential confusion or discomfort that ensures guests can focus solely on enjoying their dining experience.

Aside from that, it shows customers a transparent restaurant menu pricing model upfront that allows them to understand the total cost of their meal without surprises.

Offset operational costs

Helping to offset your operational costs is what service fees are all about.

This provides you with an opportunity for a steady revenue stream that is dedicated to covering essential expenses.

You can use the fees collected to address the rising cost of ingredients, utilities, equipment maintenance, and labor, which allows you to maintain profitability without solely relying on menu price increases.

You should distribute the collected fees evenly across all transactions to ensure consistent financial support for your operations.

Supports benefits and perks

Another focal advantage of service fees is that they fully support the benefits and perks you give to your employees.

Unlike tipping systems, where income is variable and often excuses non-tipped staff, fees like this enable you to offer helpful benefits like health insurance, paid time off, retirement contributions, and professional development opportunities.

This is an equitable approach that aims to foster a positive work culture, boost employee morale, and attract and retain talent.

Adaptable to modern payment trends

Service fees seamlessly align with modern payment trends, offering a more adaptable and efficient solution for your business and customers.

As digital and cashless transactions become increasingly popular, this fee-collection method simplifies the payment process through various digital online ordering system integrations and mobile apps.

This eliminates the need for guests to calculate tips, creating a frictionless checkout experience manually.

Embracing this, you can instantly modernize your operations that meets customer expectations for convenience not just for payment processes but your overall services.

Cons of services fees in your business

There are always two sides to the coin, and when not planned and executed correctly, business strategies like this might disadvantage you.

Here’s what you need to expect:

Customer dissatisfaction

When the intention of additional fees is not relayed effectively to customers, expect dissatisfaction in return.

In fact, Helpscout revealed that 78 percent of customers have backed out of purchases due to a poor customer experience, which includes unexpected fees.

In addition, restaurant surcharges can lead to a negative perception of hidden costs on top of bills, particularly if they are added automatically.

This can translate into unfavorable restaurant reviews that may affect your table turnover rates.

Potential for lower tips

Having service charges directly affects your employees.

Because this type of surcharge is considered non-tip wages, they are often subjected to social security tax, medicare tax, and federal income tax withholding, resulting in a lower percentage that your staff receives.

Because this type of fee is introduced, you intentionally set aside the tipping system in lieu of it to balance your customers’ perspectives.

Regulatory risks

Under the Fair Labor Standard Act of the United States, service fees are not considered tips and must be treated as regular wages.

This affects how they are taxed and reported, which may be a challenge regarding legal compliance and may not benefit staff as promised.

Reduced customer retention

Loss of loyalty among your customers is often rooted in a bad experience they get.

A study showed a significant 73 percent rate of consumers who are willing to switch to a competitor after multiple dissatisfied experiences, which also includes how service fees are managed.

Retaining regulars is much harder than getting new ones.

How to turn additional fees for services from a customer turn-off to an innovative strategy

Be transparent

Nothing beats transparency when appealing to your customers.

A survey by Label Insight found that 94 percent of consumers are likely to be loyal to a brand that offers complete transparency.

So, you can clearly disclose the fees upfront. Use your website, social media channels, or a digital menu app to inform them about the fees.

You may also train your staff in explaining about it to strengthen the dissemination of the information.

Frame service fees at restaurants as value-driven

Explain clearly what they cover.

Connect fees to tangible benefits like high-quality ingredients, better service, or eco-friendly practices.

For instance, you may indicate that they can support environmentally responsible packaging for a dollar.

Turn these fees into opportunities to promote values that align with your brand.

Provide tiered options

Instead of requiring everyone to pay a fee, you can create levels of services to offer customers various choices.

For example, a base tier with no fees or premium tiers with benefits like express service or priority reservations for additional charges.

The psychology here is you’re giving your customers an opportunity to make their own choices instead of making them feel obliged to pay when they don’t need a particular service.

Use language strategically

Although transparency is the top most priority when it comes to fees like this, which is why the term “fee” is used.

However, it may come off as intimidating for some customers. What you can do is reframe the term as an enhancement or benefit.

Instead of “Additional service free” on the bill, you can use the “Premium experience package.”

This helps in shifting the narrative to what customers can gain rather than what they pay.

Add exclusive perks to justify fees

This is a give-and-take approach.

You want to make sure that if the charges are for service improvements, they should reflect how customers feel when they receive the service.

To do this is to create a premium experience for them.

It could be reserved seating at any of your events or personalized orders. This can make them feel that they’re getting what they paid for.

Using a restaurant order management software for better service fee implementation

When introducing changes in your restaurant, particularly those involving fees, your priority should be to effectively explain the reason why to your customers.

It may be for a good cause or to improve customer service.

Remember that customers need to experience the improvements, starting with how efficient the service fee system is.

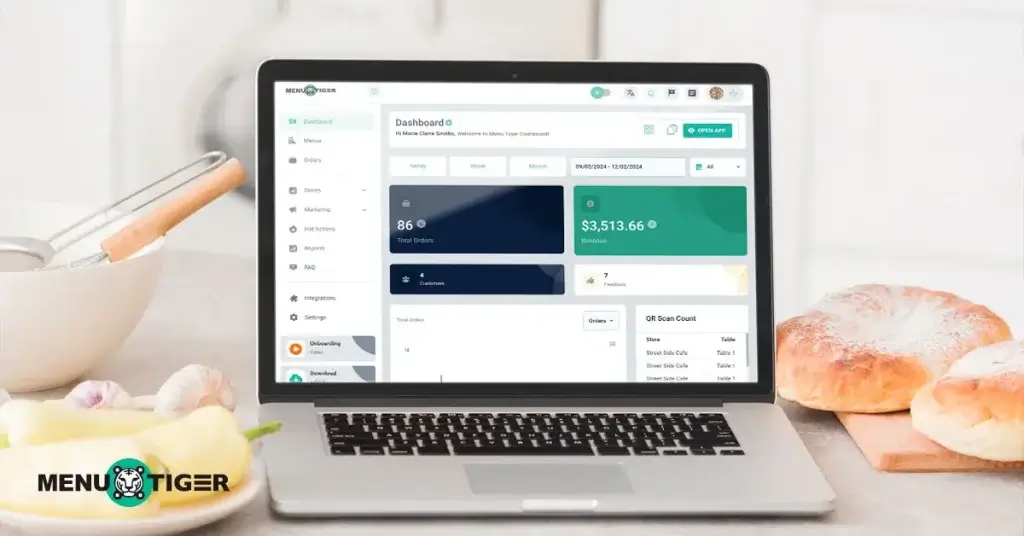

One way to assist you is to have a digital solution like MENU TIGER. This will not only help you set up these fees but also improve your operations overall.

Here’s how you can maximize this restaurant technology for your streamlined workflow:

Digital ordering through via QR code

Ease of operations and convenient dining justify having additional charges only for customers’ bills.

With a scan, your customers can access your menu items and place their orders directly on your app.

In addition, they can pay instantly without lining up at the counter or waiting for a staff member to accommodate them.

Just make sure that instructions on how to scan a menu QR code are easy to follow to avoid misuse of this tech.

Wide mobile payment options

MENU TIGER ought to provide the best services regarding payment processes.

Its payment integration lineup assures your guests that they’ll have a smooth transaction after dining.

To name a few, it has integration with PayPal, Stripe, and Venmo, which are powerhouses when it comes to digital payments.

Receipt transparency set up

This smart menu software ensures transparency in restaurant branding by providing detailed information about the transactions made using the app.

This way, every customer will know the total amount paid, including the additional charges that have been set up.

Shape your business with better services through extra charges

Service fees at restaurants are often overlooked as additional fees on the bill, which most customers would see as a turn-off.

But, with proper information dissemination as to why it is needed, this can be the best foundation for improving your overall services.

And one effective way to prove that is by using digital menu technology like MENU TIGER QR code menu software, where you can transform your whole operation system into the most advanced one in the market.

So, do you want to give your guests the VIP treatment? Join MENU TIGER for free today!

FAQs

A typical service fee varies by industry and location but generally falls within 10 percent to 20 percent of the total bill.

For restaurants, a service charge is often 18 percent to 20 percent, especially for large parties.

This percentage charge is typically added to cover various costs associated with service and operations.

It helps supplement staff wages, especially in places where tipping culture is less prevalent or where businesses aim to ensure fair compensation for all service staff, including kitchen and support teams.