Unexpected events can happen without you seeing them coming. The result can be either a breakdown or a breakthrough for a business.

Take it from the devastating global pandemic that, according to the National Restaurant Association (NRA), caused 90,000 restaurants to close in 2021.

For restaurateurs who are just getting started and those who are getting back on track after a recession, getting protected should be a top priority. How? Get a restaurant insurance.

It could be general liability, property insurance, or specialized coverage. You need to have a safety net when the worst happens.

To strengthen your protection, tapping into innovative solutions, such as restaurant ordering management, digital tools, and gadgets, can assist you in improving your daily operations and preventing incidents in your restaurant.

Dive into this comprehensive guide to find the best insurance for a restaurant business.

Table of Contents

ToggleWhat is restaurant insurance, and do you actually need it?

Restaurant business insurance serves as your safety net, protecting your business from all kinds of potential problems, such as workplace accidents, property damage, food spoilage, and other work-related issues that can be financially demanding.

Whether you’re a newbie or a seasoned restauranteur, you definitely need this insurance.

Not only is it legally required, but it safeguards your business from costly lawsuits or damages that could otherwise drain your finances.

The right mix of insurance policies ensures your restaurant can keep running smoothly even if an unexpected problem arises.

11 types of restaurant business insurance you need

If you’re new to insurance policies, you might feel overwhelmed when choosing the right one for your business.

To help with your choices, here is a curated list of essential business insurance for your restaurant:

1. General liability insurance

This covers third-party bodily injuries and property damage, which are common risks in a restaurant environment.

Let’s say a customer slips on a wet floor, resulting in an arm injury. The average claim, according to the Hartford Insurance analysis report, is around $30,000. This amount covers medical bills, legal fees, and possible settlement.

It can be financially demanding to you, especially if you are running a small-scale restaurant.

With general liability insurance, it would cover these costs, allowing you to focus on running your business without worrying about the crippling claims.

2. Business interruption insurance

Disasters can strike when you least expect them and, sometimes, can force you to close your restaurant temporarily.

This can greatly affect your cash flow, leading to difficulty in paying rent, utilities, and other ongoing expenses you have.

In fact, a study from the Federal Emergency Management Agency (FEMA) found that 40 percent of businesses failed to reopen following a disaster, and 25 percent failed within one year.

But with interruption insurance, the loss of income is covered, saving you from a possible permanent closure, as it can cover both operational and recurring expenses.

This will help you focus on rebuilding your restaurant or start venturing on how to sell food online for an additional revenue stream.

3. Property insurance

Just as important as protecting your customers is safeguarding your physical restaurant.

Glendale Injury Firm APC emphasized that property damage can significantly impact the business’s bottom line, which can be financially devastating.

Property insurance covers damage to your building, equipment, furniture, and other tangible assets due to events like fire, theft, or vandalism.

So, if a fire breaks out in your kitchen and destroys half of your cooking equipment, without this type of coverage, you’d have to shoulder the full cost of repairs and replacement.

This can cause financial losses, which may push you to shut down.

4. Equipment breakdown coverage

Your kitchen equipment is the backbone of your daily operations in any types of bars or restaurants you’re running to keep the business running smoothly.

However, equipment can and will eventually break down due to machine failure, electrical issues, or other unforeseen circumstances.

This is where equipment breakdown coverage offers a crucial safety net.

This insurance secures the repair or replacement of essential machinery that unexpectedly fails so that you can continue serving customers without any disruptions.

5. Employment practices liability insurance

As an employer, you’re responsible for creating a fair, safe, and compliant work environment for your staff.

However, even with the best practices in place, disputes can arise, leading to costly lawsuits that could jeopardize your business.

You need Employment Practices and Liability Insurance (EPLI) to protect your business against related employment issues, such as wrongful termination, discrimination, harassment, and more.

This provides coverage for legal fees, court costs, and settlements.

6. Workers’ compensation insurance

Due to the fast-paced nature of a restaurant, accidents can happen.

Your staff faces various hazards on a daily basis, from slips in the kitchen to burns from a hot pot.

So, it’s only fair to help them with their expenses by providing compensation insurance.

In most states, this insurance policy is required by law, so make sure to check your local government’s regulations to assess the terms and conditions for its coverage.

7. Liquor restaurant liability insurance

Serving alcohol in your restaurant comes with heightened risks.

While it’s part of the customer experience, alcohol lowers inhibitions, impairs judgment, and can lead to accidents or altercations that can result in massive damage.

Having this type of insurance is essential to prevent significant legal and financial consequences if a customer becomes intoxicated and causes injury or property damage.

Here’s a list of the insurance coverage:

- Bodily injury claims

If a customer becomes intoxicated and injures himself or others, your business could be held responsible.

- Property damage

This covers any repair or replacement costs of someone’s property damaged by an intoxicated customer.

- Legal fees and settlements

If your restaurant is sued due to an alcohol-related incident, liquor restaurant liability insurance will help cover your legal defense costs, court fees, and settlements or judgments if the court rules against your business.

- Dram shop laws

Many states have this kind of law, which holds establishments liable for serving alcohol to individuals who then cause harm due to intoxication.

If a server continues to serve alcohol to someone who is clearly drunk and later gets into a car accident, your restaurant could be responsible under these laws.

8. Commercial auto insurance

Recent food delivery statistics showed that 60 percent of restaurant operators saw food delivery generate great sales, which is why it skyrocketed.

And the need for transportation is quite in demand to have an efficient workflow from point A to point B.

This makes insurance a critical component of your restaurant’s risk management strategy, as unprecedented events may happen along the way.

It provides assistance to various vehicles, such as cars, trucks, vans, or motorcycles, depending on the nature of your operations.

So, if one of your delivery drivers gets into an accident while on the job, this policy would cover the costs of repairs, medical bills, and legal fees associated with any claims.

9. Crime restaurant insurance

Insurance like this comes in handy to offer you critical protection against a variety of internal and external crimes that could otherwise lead to significant financial losses.

It helps you safeguard your financial well-being, ensuring that criminal acts, whether committed by your employees or outside parties, don’t cripple your business.

10. Cyber liability insurance

Your restaurant handles a vast amount of sensitive customer data, from a restaurant order system and point-of-sale (POS) terminals to loyalty programs and digital payment methods, making it a prime target for cyber threats.

Having cyber liability insurance is necessary to ensure your protection against financial and reputational damage caused by this attack.

This type of business insurance is designed to protect businesses from financial losses that can arise when hackers steal sensitive information, disrupt your operations, or extort money.

11. Food contamination restaurant insurance

The importance of food safety in a restaurant should be emphasized, as even a minor contamination incident can have significant consequences.

If not prepared, settling medical bills and settlement fees can cost a hefty amount, and you might even face a lawsuit.

It is best to seek specialized insurance like this to protect you from financial demands caused by accidental food contamination, spoilage, or tampering.

This insurance extends beyond general liability insurance, which typically covers claims of bodily injury or property damage but does not cover specific food-related incidents.

How to choose the best insurance for your restaurant

Evaluate coverage needs based on risks

Every restaurant has unique risks based on the size, location, and services offered.

Before getting insurance, assess the risks your business might face. These could include property damage, employee injury, restaurant costs and expenses and more.

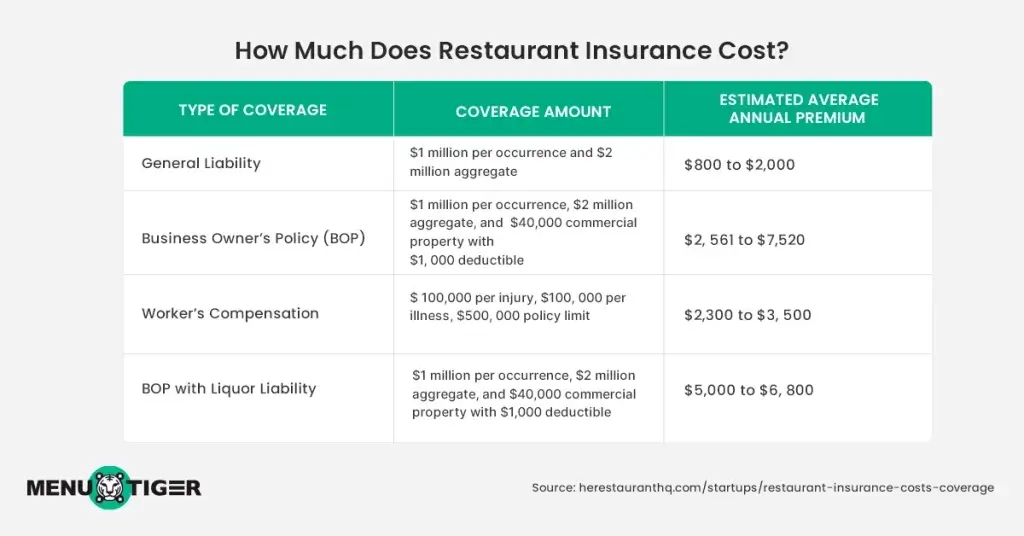

Insurance premiums for small — to medium-sized restaurants typically range between $2,000 and $7,500 per year, depending on the level of coverage.

To give an overview, here is a restaurant insurance cost breakdown from The Restaurant HQ:

Note: The amount and coverage are subject to change based on the insurance provider offers.

Look for bundle policies for cost efficiency

Many restaurant insurance providers offer a reduced rate for combining various business insurance for restaurants into a single package like the BOP.

This can be more cost-effective than purchasing policies separately.

Having a BOP can save 10 to 20 percent on insurance costs, averaging around $3,000 to $5,000 per year.

It’s a great advantage if you’re still growing your revenue.

Consider coverage limits and deductibles

While a lower deductible may seem appealing,it often leads to higher premiums. So, it’s essential to find a balance between deductible size and premium costs.

High coverage limits may also increase monthly or annual costs, so ensure the coverage matches your restaurant’s value and operational risks.

Ensure safety and satisfaction with the right insurance and advanced online menu ordering system

While insurance protects you from unexpected events, adopting an online ordering system like MENU TIGER guarantees an enhanced customer experience and streamlines operations.

This greatly improves our restaurant’s day-to-day functionality.

With the shift toward digital solutions, having an online menu is more important than ever.

Here why:

- Enhanced customer convenience

Customers value convenience, and online ordering allows them to browse your menu, customize orders, and pay from the comfort of their seats.

This restaurant technology also prevents long wait lines that may cause conflict among hungry customers and might lead to bigger disputes.

Aside from that, they no longer have to go to counters for payment and requests, which can be a little hectic, especially during busy hours that might result in workplace accidents.

- Increased efficiency and accuracy

An online menu ordering system minimizes errors that often occur during face-to-face interactions.

The customer inputs their order directly, which reduces miscommunication that might lead to complaints and ensures that every detail is captured correctly.

- Integrating with other technologies

This robust ordering system has Loyverse integration that works as a cloud-based POS system.

This integration ensures seamless communication across all departments, enhancing efficiency and minimizing errors among your staff.

- Platforms for promoting safety measures

You can build a personalized website and connect your social media channels, where you can communicate safety measures and policies to customers effectively.

Highlighting your restaurant’s commitment to safety can reassure your guests and may even reduce liability claims.

- Implement risk management strategies

Using the data from your ordering system, you can identify trends that may pose risks.

For example, if a certain dish receives frequent complaints about quality, addressing this issue can mitigate the risk of liability claims related to food safety.

Take the safest route: Protect your business with insurance and innovation

Whether you’re starting out or looking for ways to upgrade your current setup, it is best to take a proactive approach to safeguard your business with comprehensive restaurant insurance.

Along with it is to improve your customer experience using a restaurant ordering management system like MENU TIGER.

As the saying goes, “Prevention is better than cure.” So, improving the way you operate through this technology can significantly help you to avoid any liability claims.

Head over to the website, sign up, and get your restaurant insured and improved.

FAQs

A liability refers to any legal or financial obligation that your business is responsible for.

This can include potential risks such as employee injuries, customer accidents, foodborne illnesses, or damages caused by unsafe practices.

Insurance coverage is crucial for a restaurant because it protects the business from financial losses caused by unexpected events such as accidents, property damage, or legal claims.

Restaurants face various risks, which include customer injuries, foodborne illnesses, fires, or equipment breakdown.

Without insurance, the costs associated with this incident could be devastating, potentially leading to bankruptcy.