Despite the price hike and inflation-related changes in the industry, restaurant surcharges are the silver lining that helped restaurant owners provide reasonable prices for services and food.

These charges include tips, corkage, health insurance, credit card-based payments, and even a glass of potable water.

Some customers may shake their heads in dismay because of this.

However, as business owners, this might be one of the most practical ways to save your establishment and remain profitable amid inflation.

According to the National Restaurant Association (NRA), 15% of restaurant owners have added or implemented surcharges in their billing procedures.

But is this really necessary? Should you add surcharges in your restaurants, too?

If you think you might turn off your diners and eventually get the short end of the stick by squeezing in these fees or charges, there might be a need for you to reconsider.

To help out, here’s everything you need to know about surcharges from an interactive restaurant menu software marketing hub.

Table of Contents

ToggleWhat is a surcharge at a restaurant?

A surcharge in restaurants is an extra charge or fee added to the cost of a product or service. It’s a financial add-on that can take many forms depending on the context and the industry in which it is applied.

In the restaurant industry, for instance, surcharges are often transparently displayed on each customer’s bill as a corkage fee, employee healthcare, service charge, and taxes mandated by the government.

This term has been buzzing around the restaurant world for some time now.

The reason is that industry experts found this one of the best tips to recession-proof your restaurant businesses.

Navigating restaurant surcharge law

Of course, you’d definitely want to dive into the legal matters before implementing surcharges in your restaurant.

This might be a tedious job, but it will surely save your business from falling downhill.

Restaurant owners must comply with local restaurant surcharge laws, particularly regarding pricing transparency and customer disclosure.

In California, for example, there are specific laws surrounding restaurant surcharges.

Restaurant surcharge in California requires that any surcharges or fees added to restaurant receipts must be clearly disclosed to customers. Failure to comply with these regulations can result in penalties and legal troubles.

Ultimately, it’s crucial to stay informed about the legal requirements in your area and ensure that your restaurant surcharges are implemented in accordance with the law.

Types of surcharges added to restaurant receipts

As stated, these extra charges come in many forms. Here are some common types of surcharges in restaurants:

Service charge

A service charge is a standard surcharge at a restaurant added to your customers’ bill when dining out.

It’s designed to compensate the restaurant’s staff for their service. Instead of individual tipping, some restaurants incorporate a service charge, and this fee is then distributed among the restaurant employees.

This type of surcharge simplifies the process and ensures that your staff receives fair compensation for their work.

Gratuity or tip

Tipping is a customary practice in many countries, where customers add an additional amount to the bill to show appreciation for the service received.

Unlike a service charge, a tip is usually at the discretion of your customers, and the amount can vary.

Take European countries, for example. The major rule of thumb when tipping in most European countries is to pay five to ten percent.

However, this is not the case in the United States. As per industry standards, gratuity ranges from 15% to 20% on top of other fees for extra or excellent services.

Introducing these fees lets diners express their satisfaction and gratitude directly to the serving staff.

Corkage fee

For wine enthusiasts who prefer to bring their own bottles to a restaurant, a corkage fee may come in handy.

This charge covers the cost of opening and serving the wine—or, in other restaurants, all sorts of beverages—your customers bring to your establishment.

The purpose is to maintain your restaurant’s revenue since they’re not purchasing wine from your menu. And, of course, corkage fees vary between restaurants.

So, if you’re planning on adding this to your billing processes, it’s wise to benchmark from other establishment’s existing fees.

Healthcare or living wage surcharge

In recent years, specifically since the onset of the pandemic, some restaurants have introduced surcharges to support their employees.

The healthcare or living wage surcharge at restaurants is an additional fee on your customers’ bill, which is allocated to providing benefits like healthcare, cloud-based EMR software, fair wages, or employee wellness.

This approach ensures that your restaurant staff is well-compensated and taken care of, ultimately improving service quality and employee morale.

Environmental surcharge

With growing environmental awareness, restaurants have embraced sustainability initiatives by introducing an environmental surcharge.

This fee funds eco-friendly practices such as sourcing sustainable ingredients, reducing food waste, or adopting energy-efficient systems.

A study by Nielsen found that 73% of global consumers are willing to pay more for sustainable products and services, reflecting the increasing importance of eco-friendly practices.

This allows you to take steps toward a greener alternative while keeping your customers informed about their commitment to environmental responsibility.

Government taxes and fees

While not directly under the restaurant’s control, government taxes and fees add additional costs to your customers’ bills.

These non-negotiable charges include sales tax, value-added tax (VAT), or other local and state taxes.

You are to collect and remit these fees on behalf of the government, and they are essential to complying with local tax regulations.

You can do this by, for instance, adding tax rates to menu prices or implementing surcharges.

Advantages of adding restaurant surcharges

Covering rising costs

As food, labor, and other operational expenses continue to rise, restaurant owners face the challenge of maintaining profitability. Surcharges can help offset these increasing costs.

Ensuring fair wages and benefits

Many restaurants aim to provide better wages and benefits to their employees. Surcharges, such as healthcare or employee wellness surcharges, can support these initiatives.

In a restaurant employment statistics article by MENU TIGER, data showed that employees are more likely to stay in their jobs if owners allow them to generate tips, compensate their hourly service accordingly, and acquire enough benefits for their labor.

With surcharges, you can provide all these benefits to your employees.

Sustainability initiatives

As sustainability becomes increasingly important, some restaurants are taking steps to be more eco-friendly.

Restaurant surcharges offer an avenue to fund sustainability initiatives, allowing you to make a positive environmental impact.

Transparency in pricing

Nobody likes surprises on their bill. This is where surcharges added to restaurant receipts offer an essential advantage—transparency in pricing.

How much should a surcharge be? Factors to consider

Determining the appropriate surcharge amount is essential. There’s no one-size-fits-all answer, as it depends on your restaurant’s specific goals and the purpose of the surcharge.

Several factors can influence the decision:

Local regulations

Local laws play a significant role in determining the maximum surcharge percentage allowed. In some regions or states, there are strict guidelines regarding how restaurant owners should implement surcharge percentages.

In Washington, D.C., for instance, some restaurant owners now charge a 20% service fee to customers. This was revealed in an article published by WUSA9 in September 2023.

California, on the other hand, has Senate Bill 478, which was recently signed in October 2023. The legislation targets what are known as “junk fees,” which are hidden or unexpected charges added by businesses, particularly in housing, travel, and event industries.

In the same manner, New York Governor Kathy Hochul implemented the credit card surcharge law, which requires businesses, such as restaurants, to adjust their payment processes and ensure that any credit card surcharges are fully transparent and within the legal limits.

This means the surcharge amount also be totally different in various states, depending on their existing restaurant surcharge laws.

Cost analysis

A comprehensive cost analysis is a fundamental step in surcharge determination.

As a restaurant owner, you need to assess your specific expenses, including ingredient costs, staff wages, rent, utilities, and more. It’s about identifying the gap between the restaurant’s costs and profits.

To further enhance the profitability of your menu items, you can delve into menu engineering concepts or strategies.

This strategy will help you produce well-designed menus that will not deter your chances of getting a maximized profit.

Competitive analysis

To determine how much your surcharge should be, it’s valuable to look at what other restaurants in the area are doing.

While it’s not a strict benchmark, it provides insights into what customers might find acceptable.

A survey from the National Restaurant Association (NRA) revealed that 34% of consumers consider the competitiveness of pricing when choosing a restaurant.

Ultimately, this data emphasizes the importance of staying competitive when setting surcharge amounts.

Customer feedback

The voice of your customers is valuable.

Collecting and analyzing a survey for food, services, and updates on your entire restaurant operation helps gauge their reactions, especially when it comes to billing.

Happy customers are likely to return, so maintaining their satisfaction is crucial. It’s also a way to understand whether the surcharge aligns with their expectations.

How to integrate surcharges in restaurants with automated restaurant software

One of the innovative tools transforming the dining experience is the QR code menu software. With interactive restaurant software such as MENU TIGER, restaurants can seamlessly introduce and manage surcharges.

Here’s how:

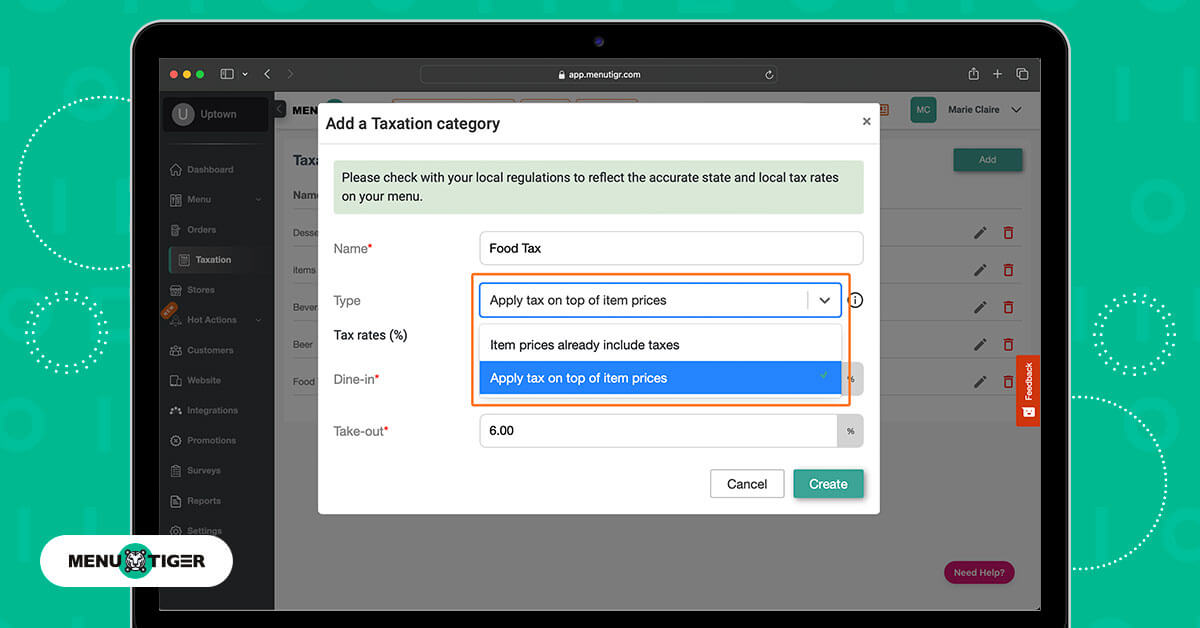

Taxation with interactive restaurant menu software

Activating MENU TIGER’s taxation feature helps you add the taxes applicable to dine-in or take-out orders automatically.

After ordering using your paperless menu QR code, your customers will get a full view of their bill plus the taxes such as VAT, sales, delivery, etc.

This will be reflected on each invoice, helping you keep a tab on each order and payment.

When you’re automating or adding tax rates to menu prices right on the software, you are promoting transparency, which increases your reliability and boosts your reputation. This will result in a strong customer relationship.

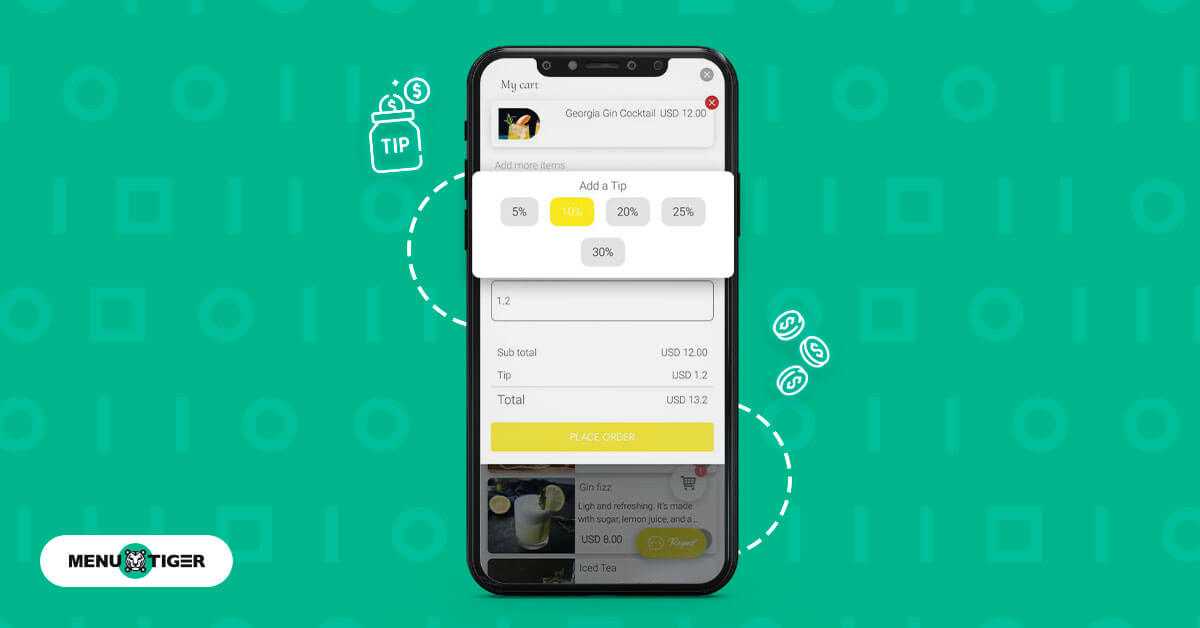

Tipping using a QR code menu

MENU TIGER tipping feature does almost the exact same thing as asking for tips over the counter, on paper bills, or automated POS invoices, but better.

It makes life easier for restaurant owners by simplifying payments, offering valuable insights, and boosting earnings.

Not only that, it also spells good news for customers.

The tipping option allows customers to decide how much they’d like to tip without the rush or pressure. It’s your way of saying, “You’re in charge of your dining experience.”

Introduce your surcharges to restaurant bills with a QR code menu software today

In the ever-evolving landscape of the restaurant industry, mastering the art of integrating surcharges with online software is essential.

With the increasing demand and challenges in handling a restaurant, it’s only smart to implement strategies to sustain your business.

Learning how to scan a menu QR code restaurant setup and actually using it simplifies the process and enhances the dining experience.

However, it’s crucial to understand the legal implications and ensure transparency when implementing surcharges.

And when it comes to tipping, communication is key to avoiding confusion.

By strategically implementing restaurant surcharges, you can cover rising costs, support employee benefits, and drive sustainability initiatives, all while delivering an exceptional dining experience.

Ultimately, it’s about finding the right balance that benefits your restaurant and satisfies your valued customers.

People Also Ask

A standard surcharge typically ranges from 15% to 20% of the total bill in the restaurant industry, based on pricing and tipping norms. This percentage varies depending on state and restaurant-specific policies.