Charging restaurant gratuity fees and tips in the U.S. has long been a standard practice in the industry. These fees play a significant role in both the dining experience and the livelihood of service staff.

Yet, for diners and owners alike, gratuity often sparks questions about fairness, consistency, and how it fits into modern dining innovations, such as the integration of a restaurant order system.

Why does tipping remain the norm in some countries while others have moved away from it? How do gratuity expectations affect customer behavior, employee earnings, and operational decisions?

In this blog, we will unpack the complexities of gratuity charges in the U.S. and explore strategies for restaurateurs to balance profitability, service quality, and employee satisfaction in a tipping-based system.

Table of Contents

ToggleWhat is gratuity in a restaurant bill?

what is gratuity in restaurant bill? It refers to an automatic or pre-set restaurant surcharge added to cover service for large parties, special events, or situations where the restaurant allocates more resources, time, and attention.

Restaurant gratuities standardize compensation for the team. It guarantees that the staff receive fair compensation, even if the group tips at a lower rate than they might for a smaller party.

So, is gratuity the same as a tip?

Unlike a tip, which is voluntary and based on the customer’s preference, a gratuity fee is mandatory and calculated as a percentage of the bill.

It’s not influenced by guests’ discretion. However, if the customer discusses it with the restaurant manager, the amount can be adjusted in certain cases.

Legalities on auto gratuity fees in the US

Can a restaurant charge gratuity automatically? The answer is yes. Auto-grats or automatic gratuities in restaurants are legal in the United States.

Federal and state labor laws determine how auto-grats are treated for tax purposes, employee compensation, and customer transparency.

Classification as a service charge

Under the Fair Labor Standards Act (FLSA) managed by the Department of Labor (DOL), automatic gratuities (like those added to large parties) are considered service charges, not tips.

This classification impacts how the gratuity is taxed and distributed among employees.

Because auto-grats are predetermined and required, they lack the “voluntary” aspect of tips. As a result, they are treated as wages under the federal law.

Taxation and reporting

Since automatic gratuity fees are treated as wages and counted as revenue, they must be included in the employee’s gross income and are subject to payroll taxes, including Social Security, Medicare, and unemployment taxes.

This also means employers must report this income on employee W-2 forms rather than through tip reporting.

Additionally, the IRS mandates that automatic gratuities be included in the restaurant’s income statements, handled like any other revenue.

Transparency and customer disclosure requirements

Just like adding tax rates to menu prices for transparency, restaurants must inform guests about automatic gratuity chargers. It should be stated clearly on menus, signs, or reservation policies to avoid misunderstandings. Failure to disclose can lead to restaurant complaints or even legal issues regarding hidden charges.

And when applied, the gratuity should be itemized on the bill. You should specify the amount or percentage charged so guests are aware of what they are paying for.

Variations in state laws

States like New York and California have specific laws regarding automatic gratuity in restaurants that may go beyond federal requirements.

For example, California requires clearer disclosure policies, while New York has established laws governing how service charges can be represented to customers to avoid confusion with tips.

Tip credit and minimum wage laws

Restaurants can generally claim a tip credit (paying less than minimum wage to tipped employees) if employees receive enough tips to cover the difference.

However, since automatic gratuity is not qualified as a tip, it cannot be counted toward tip credit.

Instead, it is treated as regular wage income, meaning restaurants must ensure employees receive at least the minimum standard wage in their state.

Pros and cons of restaurant gratuity charges

Gratuity charges come with both advantages and disadvantages. Here’s a breakdown:

The pros

- Fair compensation for staff

Automatic gratuity ensures that servers, bussers, and other team members are fairly compensated, especially for events that demand extra attention.

Unlike voluntary tips, which can vary widely, a set gratuity guarantees that the service team receives a reliable amount for their work.

- Predictable income

With gratuity charges, staff income becomes more consistent and predictable.

Traditional tipping can lead to fluctuating daily earnings, which can be challenging for your employees to budget around. Auto-grats help reduce this income invariability, as they provide a standard amount on each bill where they’re applied.

- Improved staff retention and morale

When your staff knows they will receive guaranteed compensation, they are more likely to feel valued and motivated.

This security can lead to higher morale, as employees rely less on inconsistent tips. Happy, financially secure staff are more likely to stay with your restaurant long-term, reducing turnover and creating a more experienced, cohesive team.

- Simplified tipping process

Gratuity charges make the checkout process straightforward for guests, removing the need for them to calculate and decide on an appropriate tip amount.

This simplification is particularly beneficial for larger parties, who might otherwise feel uncertain about how much to leave.

It removes the guesswork and ensures guests are not pressured to tip the “right” amount, leading to a smoother dining experience.

- Supports service standards

For exclusive dining events and large groups, gratuity charges help cover the added service requirements, allowing you to meet high service standards without sacrificing the other tables’ needs.

Larger parties often require maxing out your restaurant technology and resources—whether it’s additional staff or special arrangements.

Auto-grats justify this additional service effort and allow you to allocate resources without worrying whether staff will be compensated fairly for the extra time and attention needed.

The cons

- Potential customer frustration

Some of your guests may feel uncomfortable with a required gratuity as it removes their choice to tip based on their level of satisfaction.

This can lead to frustration, especially for guests who prefer rewarding exceptional service individually.

Your guests may feel that the charge limits their control over how they recognize good service, potentially affecting their overall dining experience.

- Legal and tax complications

The reclassification of auto-grats falling under service charges (under federal law) means that gratuities must be treated as wages, subject to payroll taxes, and reported differently from tips.

You must include these charges in your regular revenue and handle tax filings accordingly. Not doing so could increase administrative tasks and complicate payroll processing for staff.

- Increased bill amounts

Since a mandatory gratuity adds 15% to 20% to the total, the final bill is higher than the menu prices suggest.

Your price-sensitive guests may feel that they are paying more than expected and may even avoid returning, particularly if they see the policy as rigid or inflexible.

For some guests, automatic charges can feel forced, especially if they’re unprepared for the additional cost.

- Negative perception, if not properly explained

If your restaurant’s gratuity policy is not clearly communicated, it can lead to confusion and resentment.

Some guests may mistakenly believe the service charge is an extra fee for the restaurant rather than for compensating staff.

This confusion can negatively impact the guest experience, with customers feeling misled or overcharged if they’re unaware of the gratuity’s purpose and application before dining.

Alternatives to automatic restaurant gratuities and tips

Service charge

Instead of traditional gratuity, you can add a fixed service charge or administrative fee to all bills or specific bills, such as those for larger parties and private dining.

This guarantees additional revenue that can be allocated to staff as wages, bonuses, or pooled compensation.

But you should always remember that clear communication is key. Some of your guests may still expect that this charge includes or replaces a tip. You can clarify that it goes toward employee wages and operational costs.

Living wage and no-tip model

With a no-tip policy, you can raise prices to cover a living wage for all employees, eliminating the need for tipping entirely.

This model promotes fair, predictable wages, reduces income variability, and simplifies billing for guests.

Although you might want to consider that higher menu prices can be a hurdle, especially in competitive markets. Plus, your guests may still want to leave a tip out of habit.

Training staff to explain the model is essential to manage customer expectations.

Tip pooling

Traditional tipping is retained, but tips are pooled and shared among all staff, including back-of-house employees. This ensures that everyone gets the benefits.

However, some of your staff, especially servers, may feel less motivated if they are used to keeping individual tips.

So, you need to make them understand how it benefits the team and the business.

Optional service fee with a suggested percentage

This flexible model allows you to subtly guide guests to a specific tipping amount without making it mandatory.

Instead of leaving a completely open space for tips, you can list an optional service fee on the bill — typically around 15% to 20%. For example, a 100$ bill might automatically show an added optional service fee of $15 (15%).

The key here is that the fee is only a suggestion, not a requirement. Your guests can choose to accept the suggested fee, increase or decrease it based on their experience, or remove it entirely if they prefer not to tip or want to leave a different amount.

Flat table

A flat table charge or cover charge is a straightforward fee added to the bill, typically based on either:

- A per-party charge: a single fee added to each table, regardless of the number of guests.

- A per-person charge: a fee applied to each guest at the party

This charge is clearly itemized on the bill and directly contributes to employee wages, operational costs, or both.

It’s commonly used to support staff wages or offset overhead expenses, such as increased labor or fluctuating food costs.

Membership models

You can also offer a membership or subscription with benefits like priority seating, discounts, or waived service fees while contributing to staff wages.

This is one of the most effective restaurant marketing ideas that boosts loyalty while offering steady revenue. It can also improve customers’ dining experience through perks.

One thing to note, though, is that it requires up-front customer buy-in and is best suited for establishments with a loyal customer base and frequent diners.

Raising menu prices with built-in employee benefits

Instead of relying on tipping or mandatory service charges, raising menu prices creates a more stable income source for staff directly through menu revenue.

However, a Wall Street Journal video on the tipping culture in the US averred that increasing menu prices by, let’s say, 15% is considered more expensive or too much by diners than simply paying the 15% charged for service fees or tips.

So, it is still important to consider that higher prices might deter some cost-sensitive customers.

Optimistically, though, some may be open to paying a bit more when it’s clear their money supports fair wages and benefits for staff.

Clear, upfront communication about the value-added menu pricing can help align your customer’s expectations.

How to Set Gratuity Charges and Tips Using a Restaurant Ordering System

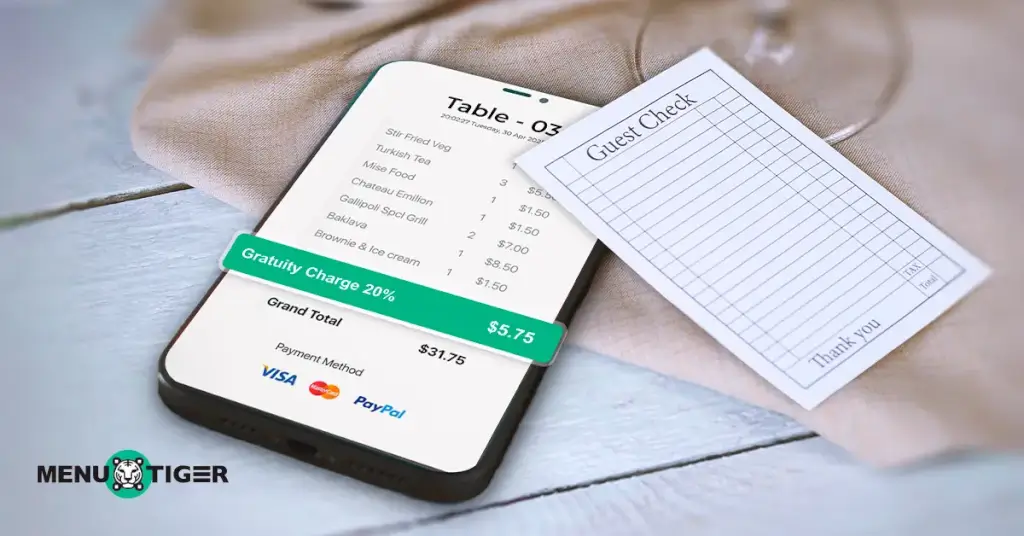

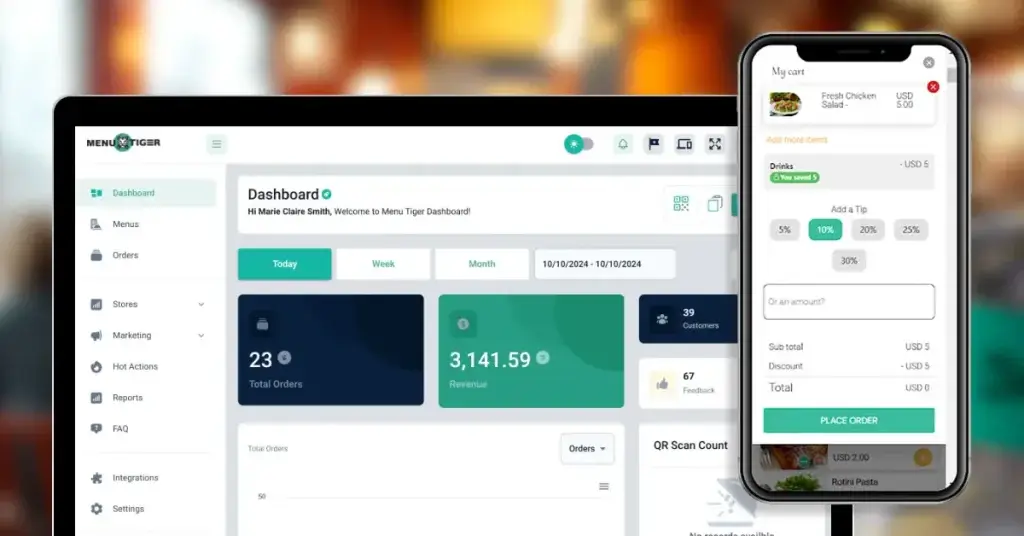

The MENU TIGER tipping feature makes it straightforward for users to set up gratuity charges and tips on their digital menu.

Once enabled, the pre-set percentage options will appear on the digital menu during your customers’ ordering journey. You can also disable this at any time.

Here’s how to set it up:

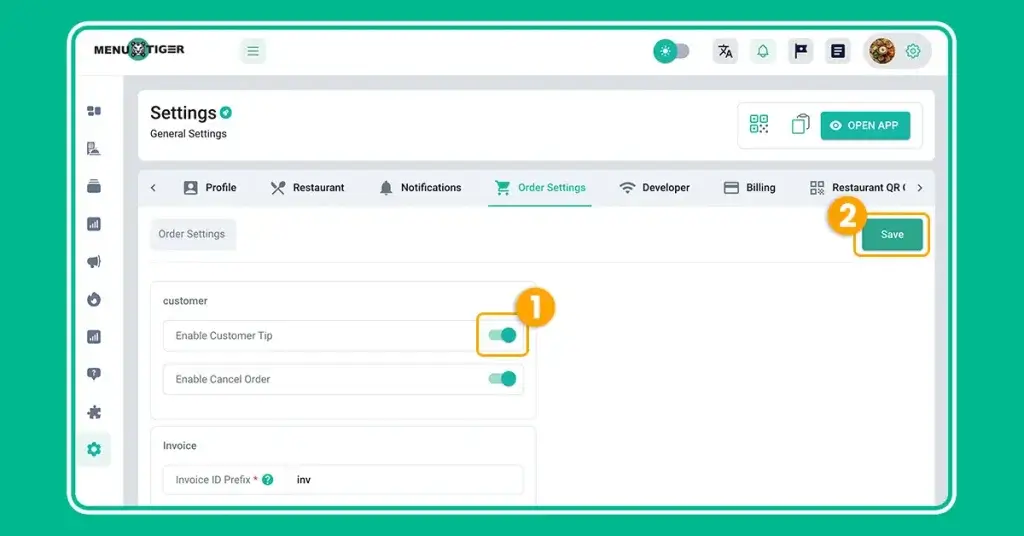

1. Open your MENU TIGER admin panel.

2. Go to “Settings” and click the “Order Settings” tab.

3. Switch the “Enable Customer Tip” toggle to the right.

4. Hit “Save” and check your online menu to verify the changes.

Easily adapt to changing gratuity practices with an advanced restaurant software

Understanding what gratuity in a restaurant is and how it impacts the dining experience is crucial for customers and owners.

As the industry evolves with innovations like the digital menu ordering system, gratuity practices are also shifting to align with modern expectations of convenience, transparency, and fairness.

For restaurant owners, balancing traditional tipping models and emerging alternatives requires careful consideration of customer preferences and employee well-being.

Tools like MENU TIGER can streamline your operations, enhance guest experience, and seamlessly integrate tipping options into your restaurant contactless ordering system.

Ready to modernize and simplify restaurant gratuity management? Explore MENU TIGER today and take your restaurant to the next level.

FAQs

Report automatic gratuity to the IRS as business income, not tips. Since these are mandatory charges, they should be recorded as part of your gross receipts. If distributed to employees, treat them as wages and include them in payroll, subject to income, Social Security, and Medicare taxes. Report these amounts on Form 941, as they’re classified as wages, not tips, per IRS guidelines.

No, it is not. As customers, you are mandated by the law to pay the charges on the receipt, which may include the gratuity fee.