Starting a restaurant business is both exciting and challenging.

One of the key driving forces for it to be sucessful is equipping it financially, which some struggle to do because it requires a huge amount.

That’s where restaurant investors come in.

They provide the capital needed for your venture and offer the necessary support and guidance to achieve your goals.

But be careful not to jump in right away, and you need to be strategic in looking for the right partners for your business.

So, you might want to ask: Is this the right investor for me?

To help you answer this question, MENU TIGER QR code menu software created this comprehensive guide with expert steps on how to find restaurant investors, how to pitch a restaurant concept, plus additional information to equip you in the world of investments.

Table of Contents

ToggleWhat are restaurant investors?

Restaurant investors are individuals or groups who give financial support to help start or grow a restaurant.

In return, they receive a share of the profits or ownership or get their money back with interest. And in looking for restaurant funding, they often provide advice, industry connections, and support to help the restaurant succeed.

This can be essentially helpful for new restaurant owners who need both financial and strategic assistance.

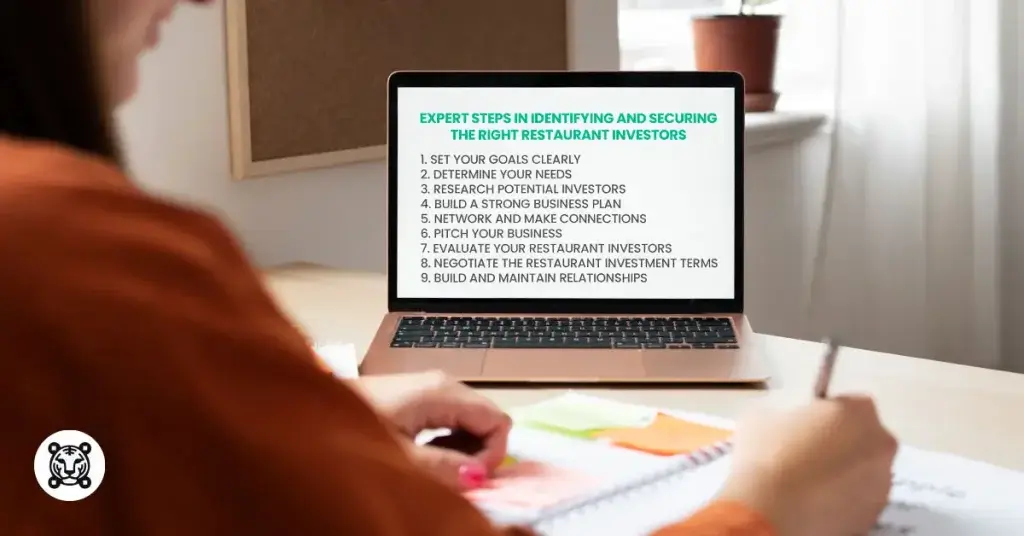

9 steps to help you identify and secure the right restaurant investors

Set your goals clearly

Setting clear goals is essential to provide you with a roadmap for effectively using the investment you will get.

What you need to do is to determine your short-term and long-term objectives. Short-term goals might include immediate upgrades to your kitchen or dining area, launching food advertisements to attract more customers, or introducing a new menu.

Long-term goals could encompass opening new restaurant locations in different cities and regions, developing a franchise model, or incorporating sustainable practices into your operations.

This clarity not only helps in attracting the right investors for restaurant business ventures but also ensures that the investment will lead your business toward long-term success.

Determine your needs

Now that you have your goals all set, calculate the amount of funding required.

Start by conducting a thorough analysis of your current financial status, including existing capital, ongoing expenses, and any outstanding debts.

If you’re opening a new restaurant, your restaurant cost might include additional recurring expenses like leasing or purchasing property, renovations, kitchen equipment, initial inventory, and other operational costs for the first few months of operation.

This detailed financial forecasting will help you determine a precise funding target that ensures your request is a realistic and sufficient amount to cover all anticipated expenses.

Research investors for restaurant funding

Look for investors who have experience in the restaurant industry or are interested in hospitality businesses.

To help you in your search, here are various investor types to choose from:

- Angel Investors

These are high-net price individuals who invest in startups and small businesses, often providing not just the capital but also mentorship.

- Venture Capitalists

These companies invest in high-growth potential businesses, seeking a return on investment within a few years.

- P2P Lending

P2P lending, or peer-to-peer lending, is a form of financing in which loans are acquired from individuals, such as banks.

Some examples are crowdfunding, where some business owners seek to raise capital from many investors online in exchange for a product or other benefits.

- Personal Investors

Personal investors are those who use their own funds to invest in businesses. This means they are personally committed and usually have a vested interest in the success of the business.

- Institutional Investors

These are large organizations that pool together substantial amounts of money to invest in a variety of financial assets, including stocks, bonds, real estate, private equity, and businesses.

These investors include entities such as pension funds, insurance companies, banks, mutual funds, hedge funds, and endowments.

Build a strong business plan

Your business plan shows how prepared and professional you are in this line of work.

The investors want to see that you have taken the time to think through every aspect of your business thoroughly.

So make sure to articulate your business vision, mission, and strategic goals for your investors to understand what your business is about, what you aim to achieve, and how you plan to get there.

As much as possible, disclose everything about your business, especially your target market and financial plan.

The clarity of your business plan significantly increases your chances of securing investment and achieving business success. So make sure you refer to relevant business plan examples to instill clarity and substance to your plan.

Network and make connections

When learning how to find restaurant investors, networking is a crucial skill you should start honing.

Grab opportunities where you can attend industry events, join networking groups, and seek advice from experienced mentors so that you can build valuable connections that may lead to investment.

With mentoring software, you can easily match with experienced professionals, track progress, and maintain structured guidance throughout your journey.

You might want to attend events and conferences like the National Restaurant Association Show, International Restaurant & Foodservice Show in New York, and Restaurant Leadership Conferences.

Attending these events allows you to interact directly with potential investors, pitch your business, and build relationships.

These events are also great for staying updated on the latest food trends and innovations, which can make your business more attractive to potential capital partners.

Pitch your business

Create a presentation that summarizes your business plan and highlights the key points of it.

Develop a concise and persuasive summary of your restaurant concept that you can deliver in a short time.

Once you have crafted your compelling pitch deck, allot a time to practice your pitch to ensure you are ready to present your proposal clearly and confidently.

A strong pitch not only showcases your business idea but also your preparedness and ability to execute your vision.

At this stage, being able to pitch your restaurant concept well can be the difference between getting a “yes” or missing out on a valuable investment opportunity.

Evaluate your restaurant investors

Suppose you already have numerous investors on your list.

The next thing you’re going to do is to research their backgrounds and investment history to ensure alignment with your business vision and goal.

You want to have investors who share your long-term objectives and values.

Consider their expertise in the restaurant industry and their ability to provide not just the capital restaurant investment but also their insights and support.

Additionally, assess their expectations for returns and involvement in business decisions to build a mutually beneficial partnership.

Negotiate the restaurant investment terms

This step is important for you and your investor to communicate the expectations and goals for both parties.

What you need to do is define the amount of capital needed and the percentage of equity you are willing to offer.

Also, discuss the investor’s expected return on investment, preferred timelines, and any performance benchmarks.

Clarify the roles and involvement of the investor in business operations, decision-making, and strategic planning.

It’s important to document all agreements in a term sheet and seek legal advice to protect both parties’ interests and establish a strong foundation for a successful partnership.

Build and maintain relationships

Establishing and maintaining good rapport with your restaurant investors is essential for the long-term success of your business.

Have transparent communication and regular updates on your business’s performance and milestones.

You can host periodic meetings or calls to discuss progress, challenges, and future plans to make your investors feel involved and valued.

Don’t forget to share detailed financial reports and key performance indicators to keep them informed about the restaurant’s financial health.

Understanding the restaurant investment structure and its types

To be able to bag investors, you have to think like one. This will help you assess your business first before sending out for proposals.

Investors thoroughly review and evaluate business’s profitability before selecting a restaurant investment structure.

This structure refers to the framework and arrangement through which capital is provided to a restaurant business.

It outlines how restaurant funding are raised, the relationship between investors and the business, and how returns are distributed.

This investment structure can impact the level of control investors have in your business, so it is necessary for you to know the basics of it.

Here are the basic types of this investment structure:

Equity Investment

The investors buy shares or ownership stakes in the restaurant.

This means they receive a portion of the profit based on their owner percentage. The higher the equity, the bigger the portion received.

They may also have a say in the management and strategic decisions of the business.

Though this type of investment has high potential returns, it also has a high risk if the business fails.

Debt Financing

Debt financing works when the restaurant borrows money from banks, financial institutions, or private lenders.

Understanding personal loan eligibility requirements is crucial when seeking this type of funding, as lenders evaluate creditworthiness, cash flow, and business viability.

The business must repay the principal amount along with the interest that comes with it.

This has a lower risk for investors compared to equity, as it has higher claims on assets in case of bankruptcy.

Take note that debt investors don’t have ownership or control over the business.

Franchising

If you’re an established restaurant, you can sell the rights to use its name and business model to franchisees.

These franchisees invest in the setup and operation of their own franchise restaurants under the brand.

In return, you, as the parent company, receive fees and ongoing royalties from the franchisees.

This investment is lower in risk and capital requirement for the franchisor compared to opening new company-owned locations.

Venture Capital

Venture capital firms invest large sums in restaurants with high growth potential.

They receive equity in return and aim for high returns through an eventual exit like a sale or Initial Public Offering (IPO).

Venture capitalists may take active roles in guiding the business.

Personal investment

Individual investors provide early-stage capital investments for restaurant businesses, particularly for startups.

In exchange, they receive equity or convertible debt.

Also, they usually provide mentorship and industry connections for businesses to widen their reach.

Crowdfunding

For crowdfunding, restaurants raise a small amount of money from a large number of people through online platforms.

Investors may receive equity or rewards like discounts or free meals once they visit the restaurant.

This can generate community support and buzz but may require substantial marketing effort.

Private placements

Here, the restaurant offers shares or debt securities to a limited group of accredited investors. This approach avoids the complexities and regulations of public offerings.

Investors in this structure typically need to meet certain financial criteria to participate.

Leveraging QR code menu technology for advanced restaurant operations

Getting an investment for any business venture needs an amount of effort, particularly in building your business plan and making an effective pitch deck.

One aspect that you can highlight is having advanced operations that guarantee a high return on investment with minimal capital needed.

This will help you reach investors who are looking for low-risk but high-return businesses.

Leveraging on a QR code menu technology like MENU TIGER provides you with not just advanced but also streamlined operations and services.

Let’s take a look at the benefits of QR code menu technology can bring:

Enhanced customer experience

MENU TIGER provides easy access to your menus via smartphones by scanning the QR code.

This enhances their dining experiences as they don’t need to wait for your staff to be accommodated or wait in long lines to complete their transaction.

This level of convenience can encourage customers to repeat their visits, potentially boosting your sales.

Pro tip: Make sure that you display inclusivity in your restaurant, especially for those who aren’t familiar with QR codes.

Simply put instructions on how to scan a menu QR code using their mobile phones on their tables.

Operational efficiency

The immediate payment capability ensures that your guests can settle their bills as soon as they finish their meals, eliminating details typically associated with waiting for a server to bring the check and process payment.

As a result, tables can be cleared and prepared promptly, allowing the restaurant to accommodate more guests within the same time frame, increasing overall revenue and improving customer satisfaction.

Cost-saving operations

By automating your ordering process, you can significantly reduce your dependence on having a large waitstaff.

Customers can now independently browse the menu, place orders, and even make payments without needing direct assistance from servers.

This reduces the workload on the waitstaff, allowing the restaurant to operate efficiently with fewer employees.

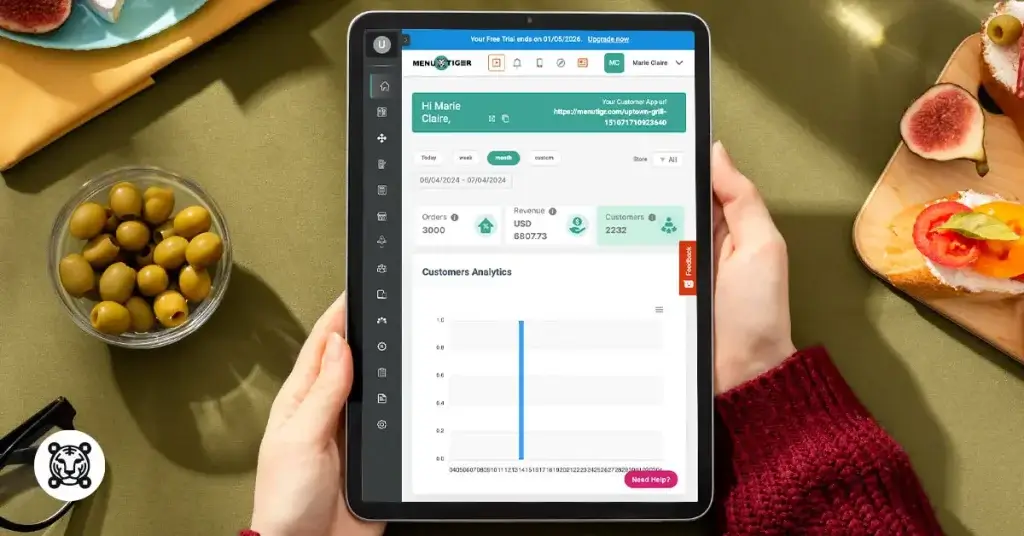

Data collection and insights

Data is necessary for investors to gauge their decisions for investment.

With this restaurant technology at hand, you’ll be able to track which menu items are most popular and at what period of the day has most customers, providing valuable insights for menu planning and promotions.

You can also collect customer feedback immediately after they dine, enabling timely improvements.

Choose the right partners for your restaurant business

Finding restaurant investors that are the best fit for your business is indeed challenging.

You need to spend a huge a mount of time and effort on research, crafting your business plan and pitch deck and attending industry events.

But the bottomline here is that your investors will look into the potential of your business to grow. And having technology like MENU TIGER QR code menu software as part of your operations, raises your chances of landing a good investment because of its innovations.

This smart menu technology offers more than just improving your system, so we highly recommend that you visit the website and sign up so you can benefit from what MENU TIGER has to offer

FAQs

Investing in restaurants can indeed be considered risky due to several factors.

The industry is highly competitive, with a high failure rate for new establishments, often cited as around 60% within the first year and 80% within the first five years.

Restaurants face fluctuating consumer preferences, high operating costs, narrow profit margins, and regulatory hurdles.

However, successful restaurants can offer substantial returns, and investors with industry expertise, strategic location choices, innovative concepts, and strong management teams may mitigate some risks and increase the likelihood of success.

The capital investment in a restaurant refers to the funds invested to acquire, improve, or maintain long-term assets for the business.

These assets include property, buildings, equipment, and technology essential for the restaurant’s operations.